Background The populations of many countriesincluding Malaysiaare rapidly growing older causing a shift in leading causes of disease and death. The Doing business in the United States guide provides newly enacted US tax law descriptions provisions updates to prior law and some practical insights for Federal tax issues.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia follows a progressive tax rate from 0 to 28.

. In such rapidly ageing populations it is critical to monitor trends in burden of disease and health of older adults by identifying the leading causes of premature mortality and measuring years of life lost YLL to. Individual Mortgage Product. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

Get a competitive home loan package that gives you the flexibility to make extra payment and calculate your interest daily to help you save in interest. Total Gross Monthly Income - Total Statutory deduction ie. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. As per the Income Tax Act whatever professional tax an individual has paid during the last year is. Our network attorneys have an average customer rating of 48 out of 5 stars.

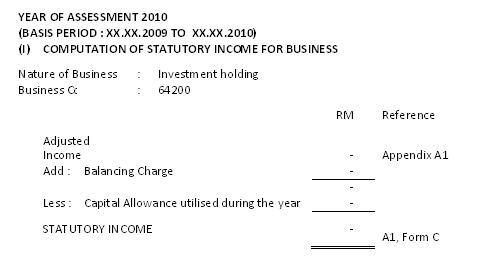

Income received from the commercialisation of a scientific research finding is given tax exemption of 50 on the statutory income in the basis year for a year of assessment for five years from the date the payment is made. Where P Total chargeable income for the year M First chargeable income for every range of chargeable income a year R Percentage of tax rates B Amount of tax on M after deduction of tax rebate for. Our network attorneys have an average customer rating of 48 out of 5 stars.

There is no ceiling in monetary terms in the Income Tax Act in article 276 of the Constitution. And the calender year is till 31st December. SOCSO PCB EPF Existing Monthly Commitments.

It is considered nearly as. Then his leaves for that calender year would be. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia.

Any State Government is not eligible to impose more than Rs2 500 annually as professional tax. Get the right guidance with an attorney by your side. Go on to the Malaysia income tax calculator to calculate how much tax you will have to pay.

In addition to providing the basic tax implications for business operations in the United States we share our observations regarding the tax consequences for US operations of global businesses. P M R B Z X -n 1. Your debt-to-income DTI ratio is the amount of debt you have to pay each month as a percentage of your gross monthly income.

Get the right guidance with an attorney by your side. Hi Pro-rata means calculation on the basis of number of days worked. Ie if one has joined on 5th of March.

To find PCB for the current month calculate. Reduce your debt-to-income ratio.

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

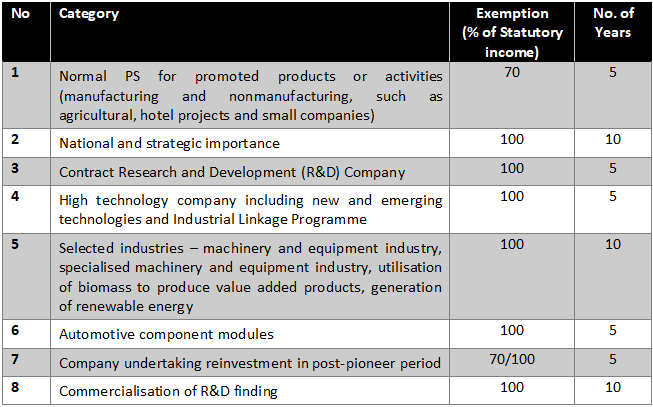

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tutorial To Malaysia Income Tax Computation Answer To Bobby Yap Youtube

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Malaysia Taxation Junior Diary Investment Holding Charge Under 60f 60fa

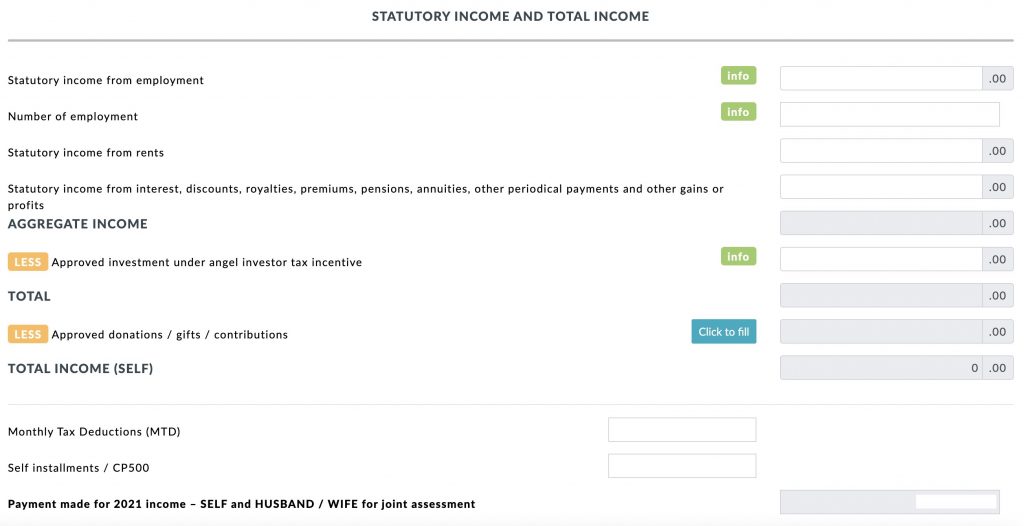

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

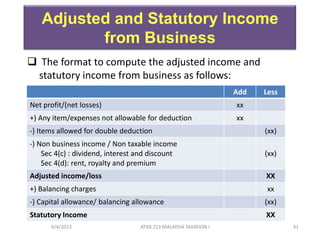

Chapter 6 Business Income Students 1

Ctos Lhdn E Filing Guide For Clueless Employees

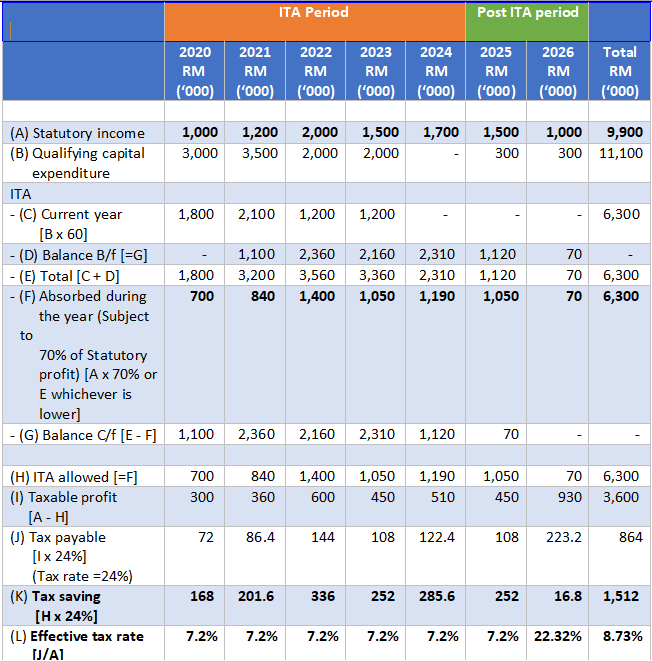

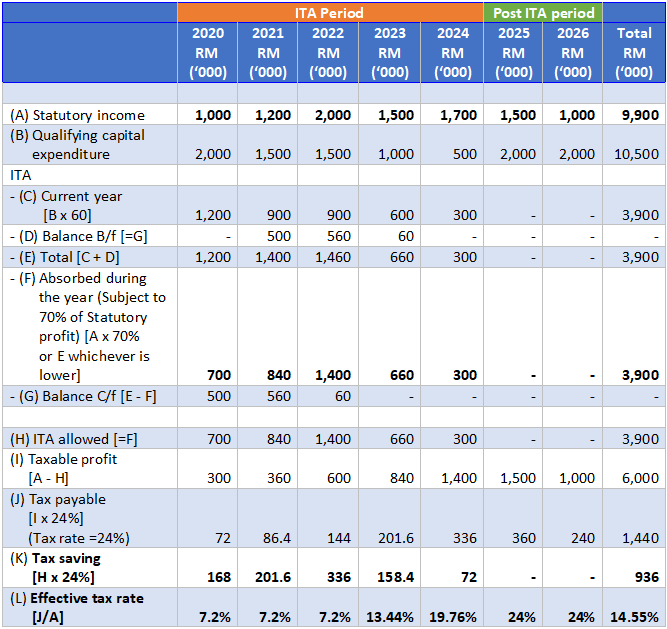

Chapter 5 Tutorial Taxation Chapter 5 Corporate Taxation Exercise 5 Corporate Tax Quick Notes Studocu

Ctos Lhdn E Filing Guide For Clueless Employees

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

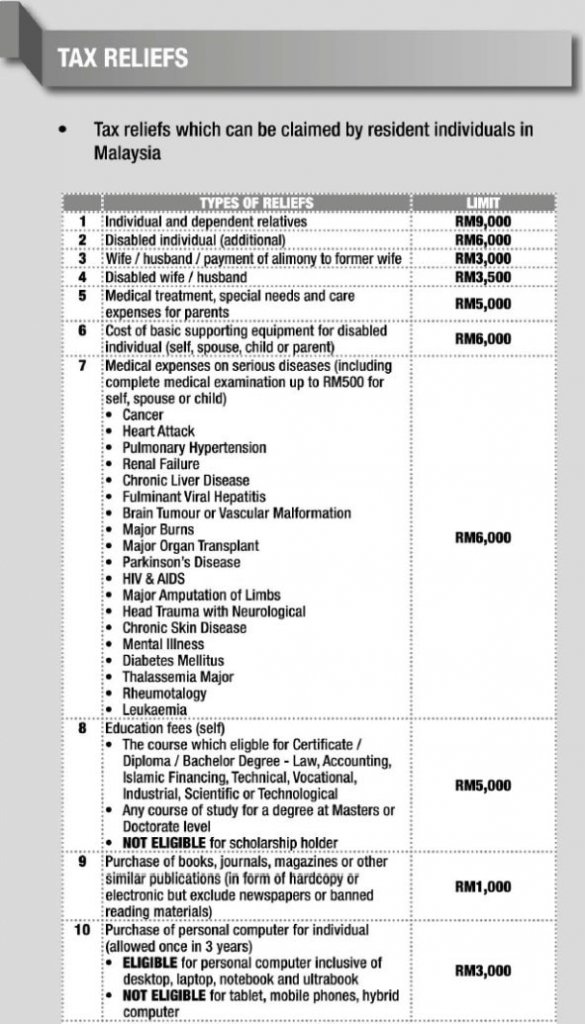

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog